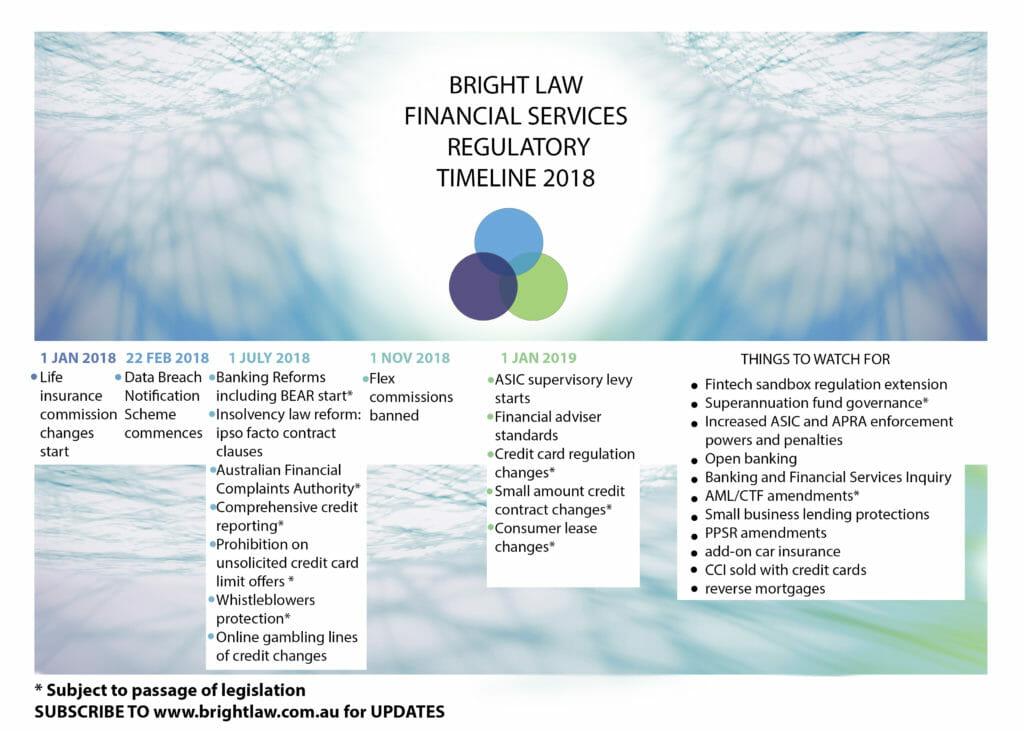

It’s time to look at what we need to do to prepare for 2018: here’s my regulatory timeline.

Click on the image to enlarge it.

Items with an asterisk indicate that they are subject to the passing of legislation.

Due to the debate on the Marriage Amendment Bill and constitutional politician citizenship matters it is expected that other legislation will not be further considered until next year.

But there is a possibility that a Bill for a Commission of Inquiry into banking and financial services will be introduced before Parliament rises for the year.

UPDATE: Royal Commission announced on 30 November 2017

Here are links to the articles on each of the issues.

1 January 2018

Life insurance commission changes start

22 February 2018

Data Breach Notification Scheme commences

1 April 2018

1 July 2018

Banking Reforms including BEAR start*

Insolvency law reform: ipso facto contract clauses

Australian Financial Complaints Authority*

Comprehensive credit reporting*

Prohibition on unsolicited credit card limit offers*

Online gambling lines of credit changes

1 November 2018

1 January 2019

Banking and Financial Services Royal Commission reports

Credit card regulation changes*

Small amount credit contract changes*

Things to watch for

Fintech sandbox regulation extension

Superannuation fund governance*

Increased ASIC and APRA enforcement powers and penalties

Small business lending protections

Reverse mortgages