In this 2.5 minute video, I give a quick glimpse of what will happen in financial services and credit regulation in Australia in 2023.

In addition to complying with existing and new legislation financial services providers also need to monitor what’s coming up.

Commonwealth Parliament is scheduled to resume on 6 February 2023 with the Budget scheduled for 9 May.

The main regulatory change for the banking, insurance and superannuation sectors will be the passing of the Financial Accountability Regime Bill 2022 and the Financial Services Compensation Scheme of Last Resort Levy Bill 2022.

The Treasury Laws Amendment (Modernising Business Communications and Other Measures) Bill 2022 will implement some of the Corporations Act financial services simplification recommendations of the Australian Law Reform Commission.

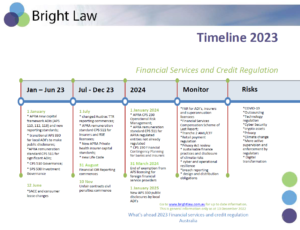

This timeline (pdf) shows the changes already programmed for 2023 and beyond.

It also shows the possible changes you need to monitor as well as known risks.

If you would like more information about the changes and how I can help you manage risks please contact me by any of the methods shown on your screen.

If you found this article helpful, then subscribe to our news emails to keep up to date and look at our video courses for in-depth training. Use the search box at the top right of this page or the categories list on the right hand side of this page to check for other articles on the same or related matters.

Author: David Jacobson

Principal, Bright Corporate Law

Email:

About David Jacobson

The information contained in this article is not legal advice. It is not to be relied upon as a full statement of the law. You should seek professional advice for your specific needs and circumstances before acting or relying on any of the content.