The Australian Financial Complaints Authority (AFCA) has published its report on the conclusion of its Fairness Jurisdiction Project which summarises work undertaken to ensure AFCA’s Fairness jurisdiction is well understood by stakeholders.

The aim of the project was to create a framework for AFCA to ensure that it was making decisions and

providing its dispute resolution services in a fair, independent and consistent way.

AFCA did not seek to define what “fairness” means in its framework.

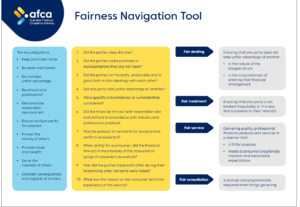

Instead, it refers to fair dealing, fair treatment, fair service and fair remediation: these four principles include how financial firms will engage with customers experiencing vulnerability, the timeliness and fairness of claims and complaints handling practice and the ethical and professional values that underpin the delivery of financial services, financial advice and financial products to Australian consumers.

AFCA has created a Fairness Navigation Tool to assist AFCA staff and the parties to identify and discuss

the key issues in a complaint against the primary legal, regulatory and codified obligations of a

financial firm.

AFCA says the Fairness Navigation Tool does not set a new standard of conduct for financial firms or reverse the onus onto financial firms to satisfy AFCA they have acted in accordance with their obligations. Consumers must still satisfy AFCA that the financial firm has breached its obligations which has in turn

caused loss.

The tool does not encompass every issue that might arise or refer to every question that may need to be

asked and answered by the parties in assessing the merits of a complaint.

The Project has included a framework to assist AFCA staff to consistently apply the fairness jurisdiction in its complaint handling and an apprehended bias policy to ensure AFCA’s people remain impartial when working with the parties to resolve complaints.

In its complaint handling AFCA says its objectives are:

- Resolving complaints to achieve fair outcomes;

- Capturing fair outcomes in terms of settlement;

- Clear articulation of reasons for decision and why it is fair.

AFCA says having regard to relevant legal principles and the law is important, but these are not the only factors AFCA may consider under its Rules.

In assessing and determining complaints, an AFCA Decision Maker must do what they consider is fair in

all circumstances having regard to:

a) legal principles

b) applicable industry codes or guidance

c) good industry practice

d) previous relevant Determinations of AFCA or Predecessor Schemes (but these are not binding).

If you found this article helpful, then subscribe to our news emails to keep up to date and look at our video courses for in-depth training. Use the search box at the top right of this page or the categories list on the right hand side of this page to check for other articles on the same or related matters.

Author: David Jacobson

Principal, Bright Corporate Law

Email:

About David Jacobson

The information contained in this article is not legal advice. It is not to be relied upon as a full statement of the law. You should seek professional advice for your specific needs and circumstances before acting or relying on any of the content.